If you’re looking for a corporate foreign exchange (FX) solution to help your business make or receive international payments, you’ve likely encountered the following roadblocks:

- You’re worried about risks and want a reputable provider that gives you confidence with your international transfers.

- You’re limited and frustrated by your current bank’s high FX costs and poor service.

- You’re running into payment issues like lost or blocked funds and get poor support from your fintech provider.

- Your understanding of FX is limited. You don’t have the expertise to keep track of currency fluctuations and other factors impacting international transfers, potentially making them more expensive and unpredictable.

- You’re paying high fees and are being stung by currency fluctuations.

To help you make an informed decision about the right corporate FX solution for your business, this article will explore:

- Key corporate FX challenges (and why your bank may not be the best option)

- What questions you should ask when picking a corporate FX solution

- Why use IFX Payments for your corporate FX payments?

- How a machinery exporter saved time and gained control over their FX with IFX

Want to learn more about how IFX can help you securely send funds internationally? Book a call with us now.

Key challenges of corporate FX (and why your bank may not be the best option)

As a small or medium-sized enterprise (SME), navigating corporate FX comes with several challenges. Below, we go through the most common ones:

- You have to pay expensive bank FX rates and fees: As an SME, you may not receive preferential rates from banks and can therefore end up paying higher charges (in many cases at a margin of around 2-5%) for cross-border payments. These high costs can add up, especially when you’re processing multiple international payments, and reduce your profit margins.

- It can be difficult to open overseas bank accounts: Opening bank accounts to make and receive international payments can be complicated and time-consuming. For example, local regulations in some countries require you to establish a local entity to open a bank account. Even setting up additional currency bank accounts in the UK can be difficult, with weeks of processing, extensive paperwork and currency options typically restricted to EUR and USD.

- You have to check, move and convert funds between different currency accounts: With your funds not being accessible via a single interface, managing money becomes difficult, time-consuming and costly. You constantly have to check multiple accounts, move money around and convert between currencies to make payments. As a result, fees quickly add up, significantly increasing your payment costs. Sending from one account to another means that you won’t have access to the funds until they arrive in the destination account.

- Invoicing with multiple IBANs is inefficient: When invoicing suppliers in multiple currencies, using a different IBAN for each one creates extra admin and slows down the whole process.

- Reconciliation with multiple IBANs is inefficient: Reconciliation is a hassle as you need to log into multiple bank accounts, download reports, manually enter the details into your system and cross-check every transaction.

- You have to make multiple payments manually: Processing multiple payments one-by-one wastes time and increases the risk of errors and failed transactions. It also drives up payment costs due to repeated currency conversions and fees.

- You may encounter payment issues with large payments: Large payments can get blocked if they are outside the bank’s risk appetite, if fraud is suspected or when more compliance information is required. While this can happen across the financial ecosystem, including with fintechs, with a traditional bank you may not get the support you need. This causes major delays in receiving funds, putting your operations at risk.

- You have to deal with limited in-house expertise and poor support: Banks don’t usually provide personal customer service or FX support to SMEs, leaving you without market updates that could help you keep track of the changes and events that could make paying suppliers or receiving money more expensive and unpredictable.

What questions should you ask when picking a corporate FX solution?

Finding the right corporate FX solution can be overwhelming when you’re faced with countless options. To make things easier, we discuss the key question to ask so you can make an informed decision.

How easy is it to move funds from A to B?

You don’t want your business weighed down by lengthy onboarding processes because wasted days mean missed opportunities and revenue. That’s why it’s important to understand what’s involved in a provider’s sign-up process, what’s required and how long it will take.

Look for a provider that can onboard you efficiently, so you can start making and receiving payments in hours, not weeks. If a provider has slow, fragmented onboarding systems, you’ll waste time submitting the same information multiple times or constantly checking for updates. You’ll also be unable to send or receive funds, which can restrict your business and block access to the resources you need.

Ideally, a provider should specialise in B2B cross-border payment solutions for a deep understanding of the unique payment challenges you face. This guarantees they can offer the right solutions to simplify your payments.

It’s also important to check whether the solution supports the currencies you need and more, so you can do business globally without limitations. Then, find out what the actual process for sending and receiving payments entails.

- How long does it take?

- What happens when you have an issue like a blocked payment?

- Can you reach human support to help you resolve the matter quickly?

How transparent and fair is the fee structure?

Cross-border payments can be expensive due to foreign exchange markups and hidden costs like receiving fees. These costs can add up, especially when making a large number of payments.

When working with fintech providers, rates and fees are often hard to interpret, and some providers even fluctuate their subscription pricing without telling you. That leaves you open to hidden fees and means you don’t really ever know what you’re being charged.

A corporate FX solution should offer competitive and transparent exchange rates and fees, so you always know what you’re paying and can plan ahead. Ideally, they should be displayed either on the website or be clear to you on a document somewhere, so you know how much you’re paying each time. There should also be someone to help you understand any complex pricing structures.

Do they require you to set up multiple accounts with different IBANs?

Juggling multiple accounts is time-consuming because you have to constantly track balances, move funds between accounts, and convert currencies to make payments. That’s why it’s important that a corporate FX solution offers a single multi-currency account with one IBAN.

This simplifies your financial operations by enabling you to send and receive multiple currencies while keeping track of all your funds from one centralised location. It also eliminates the hassle of invoicing or doing reconciliations across multiple IBANs – you can just have one IBAN on all your invoices and receive everything in one account.

Do their products help you manage the risks of currency fluctuations?

If you need to make a major payment and a politician makes a sudden change to tariffs, are you protected against the potentially huge losses from currency risk that could occur?

It’s important to look for a solution that protects your business from unexpected changes in exchange rates and volatility. Ideally, it should offer options like spot and forward contracts so you can book currency rates, have more certainty over future costs, and save money.

You should also be able to keep your funds in specific currency accounts. This gives you the flexibility to make payments when needed. It also gives you control over when you convert your funds, helping protect your margins against currency swings.

Will you always have someone to support you through complexity?

Transferring money across borders requires multiple interlinked steps. If you transfer a large amount and it doesn’t arrive at your recipient’s account, you want to know that you have the right support to resolve the matter quickly.

Large international transfers can often get paused to avoid losses from fluctuating rates. Being stuck with poor support could cause the issue to drag on for weeks, negatively affecting your cash flow and supplier relationships. In instances where cash flow is affected, a delay isn’t just an inconvenience but could impact your ability to meet financial obligations or even regulatory requirements, becoming a direct threat to your operations.

The right support can also help when with transferring money to countries or verticals with different risk profiles.

For example, if you operate in a high-risk industry like gaming or gambling, stopped or blocked payments are more common. Similarly, when sending money to countries with complex regulations or limited infrastructure, payments can be delayed, blocked or require extra documentation. In all these examples you will want to know there is someone there to talk to.

Why use IFX Payments for your corporate FX payments?

At IFX, we provide service-led payments and FX solutions that help SMEs minimise the impact of currency fluctuations on their bottom line. Our intuitive platform supports payouts to 60+ currencies and receiving in over 40.

With features like mass payments and multi-currency accounts, we simplify global payments for businesses across core verticals like shipping, travel, film and media, ecommerce, gaming and more. Here’s why we’re a great fit for SMEs:

Access service-led support from people with 20 years of experience

Whether by phone or email, you’ll always have someone to speak to if you need support or if you run into issues like failed or delayed payments. As a fast-growing SME, we understand that you need a corporate FX solution provider you can rely on to keep your international payments fast, secure and stress-free. Whatever the issue might be, we will always do our best to establish the cause and provide support where possible.

IFX has been in business for 20 years, and we work with Tier 1 banking partners. On top of this our 4.5-star Trustpilot rating reflects our commitment to the highest levels of professionalism and service.

Our commitment to being the number one service-led provider for SMEs goes even further: when you partner with us, you get a dedicated relationship manager. One who knows your industry and works with you to understand:

- Your business and how it works

- What payments you make

- What your pain points are

- Your specific cash flow pressures

- What your objectives are

- Your supply chain

Because we’re helping you navigate FX challenges and keep up with market developments, you can plan ahead, make confident decisions and stay focused on growing your business.

Use an FX solution designed to make international payments easy

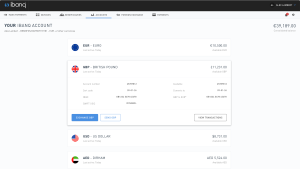

The ibanq multi-currency account screen

Managing FX can be complicated, especially when you factor in currency fluctuations, unpredictable costs and managing different currency accounts. At IFX, we simplify FX through a multi-currency account that allows you to collect in 40+ currencies or pay out to 60+ — all through a single IBAN.

This means you can manage all your payments quickly, conveniently and more cost-effectively via one user-friendly platform instead of juggling multiple currency accounts.

Taking into account the various payment needs of SMEs, we’ve designed ibanq, our FX platform, to deliver a seamless user experience. Benefits include real-time FX rates and the ability to automate key workflows.

- You get transparent fees and competitive rates: IFX can usually offer bank beating exchange rates, allowing you to save on every transaction. We also communicate all pricing charges upfront so you’re not surprised by hidden fees after each transaction. This transparency allows you to plan effectively, manage your cash flow with confidence and know you’re getting competitive rates.

- You can hold multi-currency funds: IFX allows you to hold funds across multiple currency accounts, so you don’t need to constantly convert between currencies just to make payments. This also gives you control over when you convert your funds, so you can avoid unfavourable rates and protect your profit margins.

- You can mitigate currency risk: We offer unregulated forward contracts so you can book a currency rate for a future date. This means you can forecast how much a conversion is going to cost you, manage the fees and plan better. For example, if you need to make a payment in USD in 30 days, you can choose to lock in today’s exchange rate, potentially saving your business a lot of money if exchange rates change unfavourably during the month.

- You can set up sub-accounts: If you need separate accounts for different suppliers or brands, our multi-account setup allows you to hold as many accounts as you need in one place without the hassle of setting them up individually. You can choose to use a single IBAN for your parent account or assign individual IBANs for specific sub-accounts, giving you total flexibility in how you organise and report on your funds.

- You can invoice and receive payments more quickly: With one IBAN, you no longer need to access and enter different account numbers each time you’re invoicing in multiple currencies. This simplifies your workflows, saves time and reduces the risk of errors.

- You can do reconciliations easily: A single account also makes reconciliation straightforward. It eliminates the need to track money flowing in and out of multiple accounts, exporting reports in various formats and manually entering each one into your main system for auditing, streamlining the reconciliation process.

- You can make faster, error-free mass payments: When you need to pay hundreds of international suppliers or employees, we offer a mass payment solution with automatic error checking, currency conversion and mass upload capabilities. This saves significant time compared to processing one at a time and reduces the risks of errors and failed payments.

How a machinery exporter saved time and gained control over FX with IFX

A UK-based machinery exporting company with clients in Europe, America and Asia, wanted to be able to receive money and invoice people a couple of times a day.

However, they were managing their FX needs through multiple providers, making the process fragmented, time-consuming and inefficient.

Our dedicated teams worked closely with the company to understand crucial details, including:

- Their flows

- What they were looking to achieve

- What their budget was

- Their product costs

- Where foreign exchange fit into the overall view of their costs of goods sold

When they partnered with us, they migrated all their FX and international payments from two providers, making IFX their sole corporate FX solution. We helped them expand into other markets and use suitable FX products.

In addition to the infrastructure to simplify their FX, we supported them and offered a lot of guidance about what they needed, how they were going to grow and how IFX was going to fit into that. As a result, they saved time, simplified their operations, and gained control over their FX strategy.

Work with IFX Payments to make FX work for you

Navigating international payments can be complex, costly, and risky. At IFX, we offer corporate foreign exchange solutions to help you do business internationally cost-effectively.

What sets us apart is that we work with you as a partner, collaborating to help you understand what your business needs are and how you’re going to work internationally. Whether you’re making or receiving international payments, we work diligently behind the scenes to ensure everything flows smoothly.

The contents of this article do not constitute financial advice and are provided for general information purposes only. Links to third-party websites are included for convenience only, and IFX Payments holds no responsibility for the content, services, products, or materials on those sites.