Mass Payments

Mass Payments

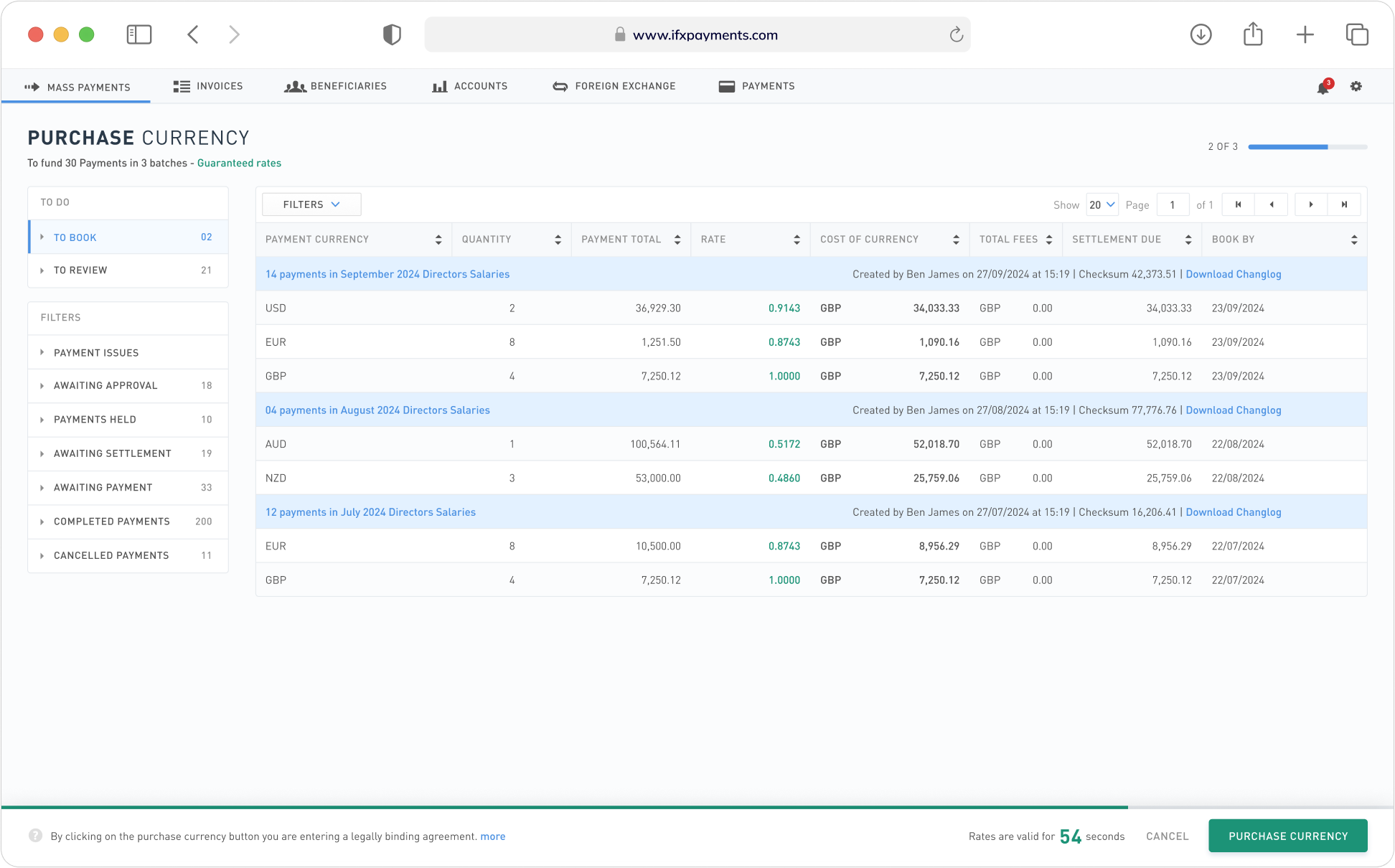

Mass Cross-Border Payments

Simplify your large-scale payments operations with ibanq. Our international liquidity network gives you access to over 100 currencies, so you can process international payments in bulk without having to open local currency accounts.

What Our Clients Use Our Solution For

Global Payroll

International Supplier Payments