If you’ve been sending or receiving funds in multiple currencies via your bank, you might find that it’s starting to get expensive. Payments are taking days or even weeks to clear, which can disrupt your supply chains or other vital operations. And, if a payment fails, it takes a long time to resolve the issue.

Similar problems can also arise with mass-market fintech providers. Payments can get stuck, with no visibility of where they are.

To make matters worse, it can often be hard to get through to anyone for support.

Sending and receiving international payments should be fast, with competitive fees and exchange rates. Ideally, you can get straight through a human when you need support. This is why a service-led cross-border payment solution is the best approach.

In this article:

- Why you might want to rethink your cross-border payments strategy

- When to use banks vs specialised cross-border payment solutions

- Why IFX is a good solution for cross-border payments

- Why a gambling company switched to IFX for one on one service and better reconciliation

Want to get started with a cross-border payment solution? Book a call with our team to learn how IFX Payments can help you.

Why you might want to rethink your cross-border payments strategy

If you’re relying on traditional banks, mass-market fintech providers, or other service providers for cross-border payments, you may be facing challenges that justify a rethink. We break down the most critical ones below:

You’re juggling multiple currency accounts which is time-consuming

If you’ve set up multiple separate currency accounts or IBANs to simplify your cross-border payments, you might be finding that it’s actually complicating the process.

As you can’t access all of your accounts via a single interface, managing your funds is not only complicated but also time-consuming. If you need to pay suppliers in ten different currencies, for example, you first have to check that each account has sufficient funds. If any are low on funds, you have to move money between currencies and top them up one at a time.

You’re paying multiple suppliers manually which takes time and resources

Like most small or medium enterprises (SMEs), making payments to suppliers probably involves logging into your banking interface, creating recipients, adding payment details and handling currency conversions line by line.

For one or two payments, this is manageable, but as payment volumes increase (for example, if you need to pay 50 suppliers), the manual steps involved become more time-consuming. Errors can occur, requiring payments to be redone, resulting in delays, extra work and wasted time.

Your FX costs are high and unpredictable, eating into your profit margins

When dealing with cross-border payments, exchange rate markups, transfer fees, and additional charges can quickly add up. Traditional banking often involves multiple intermediaries and legacy payment networks, which further increases costs and complexity.

When you’re making payments to jurisdictions where infrastructure and payment rails are limited or fraud risks are higher, transaction costs are even steeper. This means that as your payment volumes grow, your profit margins decrease.

If you’re relying on your bank for cross-border payments, charges can be at a margin of around 2-5%. Not that you’d always know beforehand.

Bank and financial institution charges aren’t always transparent so you can be hit with extra costs like receiving fees, which further erode your margin on each transaction. Even fintech pricing can be costly and unpredictable, with some providers fluctuating their subscription pricing without warning.

You’re dealing with poor support, putting your cash flow and operations at risk

As an SME, you’ve likely tried to get support from your bank, only to be left frustrated. They didn’t understand your business, or you were transferred from one agent to the next with no solution to your problem. Widely used mass market fintech providers may not be any better. With low-touch/no-touch models, you often have to deal with chatbots, documentation, or FAQs for help, resulting in a poor customer experience.

When to use banks vs specialised cross-border payment solutions

When evaluating banks and specialised cross-border payment solutions, there are a lot of factors to consider.

For example, banks come with the reassurance of being well-established, strictly regulated, and offering a full range of financial and payment services. But that comes with potentially higher foreign exchange (FX) rates and slower payments. You’re also unlikely to receive tailored support or guidance for managing your cross-border payments.

Specialised cross-border payment providers, on the other hand, offer more competitive FX rates, fast payments and other functionality like virtual IBANs, bulk payments and API integrations.

However, they may have a smaller service offering, depending on the type of licence they have. Another potential drawback is that many of the large providers aren’t able to offer the personalised support fast-growing SMEs need. However, other providers (like IFX) that focus on serving SMEs, have a more service-led approach.

To help you compare the two, we’ve summarised their key pros and cons in the table below.

| Traditional Banks | Specialised Cross-Border Payment Solutions | |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

| When It Makes Sense |

|

|

If you’re not regularly dealing with cross-border transactions, your primary GBP bank account might be all you need. However, if you’re a business doing payments globally, relying solely on your bank can chip away at your profit margins and limit your ability to scale.

Switching to the right specialised cross-border payment solution can optimise your payments, enabling you to become a truly borderless business. However, make sure it can actually solve your use cases by:

- Offering dedicated support

- Providing one convenient multi-currency account

- Charging competitive and transparent fees

- Automating mass payments

Why use IFX for cross-border payments

At IFX, we combine 20 years of expertise with efficient solutions like multi-currency accounts, bulk payments and foreign exchange to make global payments fast, cost-effective and reliable.

Our payments platform supports payouts in over 60 currencies and collections in over 40, with rates that are often more competitive than traditional banks. But we do work with Tier 1 banking partners and are focused on ensuring you benefit from a reliable foundation alongside the flexibility and support of a specialised payment provider.

We also know how complicated international bank transfers can be, which is why we invest heavily in great support too. As an SME, here’s how you’ll benefit from our service-led solution:

Simplify cross-border payments with one multi-currency account and a single IBAN

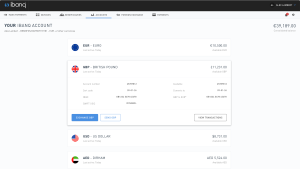

The ibanq multi-currency account screen

Having to manage multiple currency accounts or IBANs can create administrative inefficiencies. That can include constantly tracking balances and moving or converting funds between currencies.

IFX simplifies this with a multi-currency account that lets you receive and pay in 40+ currencies, all via a single IBAN.

Not only does this account enable you to manage all your online payments from a centralised dashboard, but it also offers you the flexibility to create up to 1000 sub-accounts each with their own distinct IBAN too. This makes it easy to organise and separate funds by brand or whatever suits your business model.

For example, if you run a travel company and need separate accounts for tour operators in different countries, we can set them up automatically under your parent account. This streamlines account management and reduces manual setup time. Each sub-account will have its own IBAN but remain connected to the parent IBAN. Everything is available via one dashboard, simplifying your payment processes and payment flows.

The benefits of our multi-currency accounts also extend to important processes like invoicing and reconciliation. When invoicing in multiple currencies, you can use the same IBAN on all your invoices, saving time and reducing the likelihood of errors.

Reconciliation is also easier. You no longer have to track money moving through multiple accounts, download reports from each and manually enter the data into your system for cross-checking. Even if your business model requires multiple sub-accounts, our centralised setup ensures your financial operations stay efficient and organised.

Get personal support so you know what’s happening to your payments

We often hear from SMEs who’ve run into issues like payments being delayed. Poor support in these instances exposes SMEs to cash flow problems and critical operational disruptions.

That’s why we take a different approach. As a service-led provider with a 4.5-star rating on Trustpilot, we make it a priority to ensure that you receive dedicated support from a knowledgeable team helping you manage your cross-border payments efficiently.

We do this by ensuring that you can always reach someone via phone or email for quick and efficient help. Our teams may have knowledge of certain core industries you may operate in and so understand the situations you may find yourself in.

Whether it’s a delayed payment or FX trade support, our commitment to responsive, reliable service means you’ll have access to a dedicated account manager for consistent support.

Make multiple cross-border payments in minutes, not hours with our mass payment solution

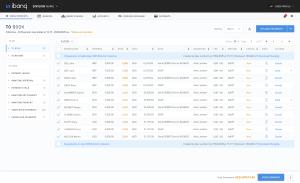

ibanq Mass Payments screenshot

Making multiple cross-border payments manually can take up hours of time better allocated to more strategic activities.

With our mass payments solution, you can pay multiple suppliers or employees in one go by uploading a single CSV file. Features like error checking and currency conversion simplify the process further and reduce the risks of errors and failed payments.

Manual payment entry that once took four people a week to complete, will take approximately 15 to 20 minutes with our bulk payments solution. Your team is then free to focus on other tasks to make your business efficient.

Always know how much you’re paying with every transaction

Cross-border money transfers are expensive, and the costs can add up significantly. This is especially true when working with banks, where charges may be higher (e.g. a margin of up to 2-5%) and less predictable.

IFX offers rates that are often more competitive than traditional banks. While you may not know what you’ll be paying with a bank, IFX prioritises transparent rates and fees. We do this by clearly communicating all pricing charges upfront so you can better understand your costs.

We make sure that you understand our pricing and how it compares to other options. That way, whether you are making cross-border payments or receiving them, you can be assured you’re getting the most competitive rates.

Why a gambling company switched to IFX for one-on-one service and better reconciliation

A gambling company was dealing with frequent payment issues and poor support from their previous provider. Operating in a high-risk industry, their payments kept getting delayed or stopped for KYC checks, but they couldn’t reach anyone for support.

They also needed multiple virtual IBANs to manage multiple brands and simplify reconciliation but were limited to just one.

We stepped in and provided multiple virtual IBANs for each brand through our multi-account setup, which makes it easy to add and manage sub-accounts.

They also gained access to our service-led support solutions. From the initial sales call onward, they would have access to a dedicated account manager for consistent support. Whether it was a lost payment or something else, help would always be a phone call, email, or message away.

Ultimately, what mattered most to them wasn’t the cost, but fixing the ongoing issues. This was because IFX delivered the service and solutions to resolve the pain points that had been affecting their operations.

Use IFX to make cross-border payments easy

If rising payment costs, delays, or failed international transactions are disrupting your operations (and poor support is only adding to the frustration), it may be time to consider a specialised cross-border payment solution.

As payment experts, we’ve not only designed reliable cross-border payment solutions, but we’ve also perfected our service. With IFX, you get more than a cross-border payment solution. You get swift service and the confidence that your payments will always run efficiently.

FAQs: Cross-border payment solutions

What is a service-led cross-border payment solution?

A service-led solution combines powerful payment infrastructure with dedicated support from real experts. It means you get fast, reliable cross-border payments, with a human on hand when issues arise.

How is IFX different from other cross-border payment providers?

While many providers offer competitive rates or automation, few combine this with true service. IFX gives you a single multi-currency account, efficient bulk payments, and proactive support from day one.

What are the different types of cross-border payments?

Cross-border payments (also known as remittances when transferring funds internationally) can take several forms depending on the business need. These include:

- Supplier payments: Paying international vendors or partners for goods and services.

- Payroll: Sending salaries to overseas employees or contractors.

- Customer refunds: Reimbursing international customers in their local currency.

- Repatriation of profits: Moving funds back to a home country from international operations.

- Treasury movements: Shifting capital between international accounts for liquidity or investment.

IFX supports all of these, with tools like bulk payments, currency conversion, and multi-account management to streamline your process.

Can I use IFX alongside my existing bank?

Yes. Many of our clients use IFX for international payments while keeping their existing bank accounts for local operations or lending. We offer a flexible solution that fits around your business.

What types of businesses benefit most from IFX?

We work best with SMEs, scaleups, and industry-specific companies (e.g. travel, gambling, logistics) that deal with multiple currencies and high volumes of payments.