If you’re an SME paying overseas suppliers, you’ve probably reached a point where you want faster, more cost-effective payments and reliable support when something goes wrong. The following challenges are common:

- You’re battling slow payments and delays:Traditional banks may rely on legacy technology, which slows them down. Meanwhile, mass market fintech providers (which serve consumers hungry for easily accessible mobile solutions) may have a low-touch approach that can leave some customers in the dark when delays occur.

- High payment costs are hurting your margins: As your payment volumes increase, high foreign currency conversion fees, bank transfer costs, and credit card fees may increase as well.

- You’re struggling with payment issues, and there’s no one to speak to: Limited support from your bank or mass market fintech provider makes it harder to manage FX risks or supplier payment issues like delays and returned funds. Issues can take weeks to resolve, putting your relationships with international suppliers at risk.

If any of those scenarios sound familiar, we’re here to help. In this article, we’ll explore:

- The top 4 options for paying overseas providers

- What to look for in an overseas payments provider

- Why IFX Payments is a great solution for paying overseas suppliers

- How two companies simplified overseas supplier payments with IFX Payments

If you’d like to pay overseas suppliers quickly and easily, IFX Payments can help you. Book a call with us today.

Top 4 options for paying overseas suppliers

Not all options for paying international suppliers are created equal or are ideal for SMEs. In this section, we briefly discuss the most common ways to send payments abroad (e.g. international bank transfers, credit cards, and mass market fintech providers) and how these services compare in terms of speed, cost, and more.

1. International bank transfers: Easiest option, but can be expensive and slow

International bank transfer is a natural starting point for most businesses sending money overseas. They have wide coverage and are usually the easiest option since you can use your existing bank account. However, they come with downsides that make them less suitable as your business payments grow in volume and complexity.

International bank transfers to overseas suppliers can take days, even weeks. They involve multiple intermediary banks and security measures. Each bank’s risk appetite may be different, which can lead to further delays, longer processing times, and blocked payments.

They’re also expensive. This is likely because they include intermediary bank charges, various transaction fees, and other charges (e.g. margins that can be in the region of 2-5%). There’s also little visibility during the process, meaning you can’t always see the progress of your payments. And when payment issues arise, banks typically offer limited support, leaving payment problems unresolved for weeks.

2. Credit cards: Convenient but expensive

Credit cards are often considered a more convenient way to make payments to international vendors. Settlements are completed in seconds or minutes, and they come with other benefits like cash flow management, fraud protection, and rewards. All this makes them a popular choice for SMEs.

However, card payments also come with high exchange rate costs plus processing fees, which are typically 1.5-3.5% for each transaction. You also have to factor in potential repayment interest rates and foreign currency charges, which can push your costs even higher. On top of that, credit cards can be limiting because you can only transact within your assigned credit line.

And finally, credit cards don’t support bulk payments. So, if you need to pay large volumes of suppliers each month, you’re stuck doing them line by line.

3. Mass market fintech providers

Money transfer solutions tailored to consumers offer a range of features that make paying overseas suppliers cheaper and faster, including digital wallets, user-friendly apps, and multiple virtual accounts. This is why they’re often the first port of call for SMEs who are frustrated with their bank.

However, the sheer size of these service providers means they don’t have the resources to prioritise individual payments. They’re unlikely to step in if there’s a delay or a payment gets stopped. In some cases you won’t even know an issue’s occurred until you get a call from a disgruntled supplier.

These providers also tend to be low-touch or even no-touch in terms of support. So, if you have payment questions or issues, you’re stuck trying to figure these out via a chatbot, documentation, or FAQs.

You may also have to deal with unpredictable pricing. For example, some of these providers have tiered subscription models which can be costly and unpredictable. You could start on a subscription plan with a certain transaction limit but then have to upgrade to access higher transaction limits. Costs can creep up, and you may not always know what you’ll be paying from the outset.

4. Specialised cross-border payment provider like IFX Payments

In addition to banks and credit cards, there are financial services providers like IFX, that specialise in cross-border business payments.

B2B fintech providers, like IFX, know that business operations rely on a reliable flow of money to and from all parties. They also understand the importance of keeping costs down to protect margins. So they focus on ensuring that cross-border payments are made quickly and successfully. And, since business clients typically make overseas payments regularly and in high volumes, they usually don’t impose limits on the number of transactions you can make.

Since B2B fintech providers are not serving the same volume of customers as mass market fintech providers or banks, they tend to be more hands-on and offer proactive, customer. This makes them more user-friendly, especially when issues arise.

In addition to supporting a wide range of currencies, these providers come with useful features such as multi-currency IBANs, bulk payment solutions, and FX services.

We’ll go into more detail about specialist cross-border solutions when we explain the benefits of IFX below.

To help you compare the different payment options and types of providers, we’ve summarised their key pros and cons in the table below.

| Pros | Cons | |

| International bank transfers | – Established payment infrastructure- Convenient for existing bank account-holders | – Slow processing times – Sometimes limited to major currencies (e.g., USD, EUR)- Potentially high exchange rates and non-transparent fees |

| Credit cards | – Faster payments- Potential rewards schemes based on spending

– Can help manage cash flow due to spreading out the cost |

– Potentially high fees- Potentially high exchange rates

– Credit limits – Interest charges |

| Mass market fintech providers | – Faster processing- User-friendly apps – in some cases | – Potentially unpredictable/tiered fees structures- Transaction limits – in some cases

– Low-touch or no-touch support |

| Specialised cross-border payment solution | – Payment visibility- No local entity setup required

– Efficient account opening and onboarding – Faster processing – Competitive exchange rates |

– Not part of a standalone banking solution |

What to look for in a cross-border payments provider

The provider you choose will have a direct impact on how efficiently you can pay overseas suppliers, reduce costs, and build stronger supplier relationships. To help you make the right decision, here’s what to look out for in a cross-border payments provider.

Are they fast and reliable?

The best overseas payment provider should tick certain boxes. To find out if this is the case, here are some key questions to ask:

- Is the platform easy to use? A user-friendly interface makes it easier to integrate overseas supplier payments into your workflow, saving time and reducing the risk of errors.

- Are they there to help when things go wrong? When issues arise, you need responsive, knowledgeable support so you’re not left on your own.

- What currencies do they support? Broad currency coverage means you can pay suppliers that aren’t sanctioned and confidently expand into new regions without relying on local payment infrastructure.

- How do they process payments? Whether through wire transfer via SWIFT, SEPA, Faster Payments, or other payment networks, the processing method can affect speed, cost, and reliability.

Do they offer personalised support to keep payments running smoothly?

Delays and payment failures can happen and sometimes you need to provide more information to complete the payment. Without the right customer support, these issues can take weeks to resolve, resulting in delayed payments, late charges, and friction with suppliers.

The right provider understands that payment issues need to be handled quickly and has the right systems in place to provide effective support. They’re and reach out if more information is required, helping you avoid delays.

Do they help you keep your overseas payment costs low and predictable?

Overseas payments can be costly due to potentially high foreign exchange markups and other possible fees.

When making a large number of supplier payments, these costs can add up, affecting your margins. To help manage your payment costs, look for a provider that offers competitive and transparent exchange rates and fees. This means competitive exchange rates and clear fees that are communicated upfront so you can manage your costs.

Another cost to manage is the fluctuation of FX rates. FX markets can be volatile, and currency fluctuations can result in having to pay suppliers more in one month than another. This makes it hard to predict and manage your payment costs. So, it’s important to understand the risk management strategies a provider can offer to help mitigate currency fluctuation risk. One example is providing deliverable forward contracts for the payment of identifiable goods and services which can be a tool to mitigate currency risk.

Do they have a bulk payments option?

As your business scales and your supplier payment volumes increase, making lots of manual payments will take up valuable time and may increase the risk of failed payments.

To avoid the hassle of extra admin or failed payments, ensure your provider has a bulk payments solution. This will allow you to automate repetitive, manual tasks, reduce errors, and make your payments more efficient.

How easy is it to manage multiple currencies?

Most banks offer access to just two or three currencies (usually GBP, EUR, and USD) and each currency account comes with its own IBAN. This makes reconciliation more complicated because you have to combine balance sheets from different banks. Plus, you’ll need different invoices with different IBANs for different currencies. You’ll also need to ensure each bank account has sufficient funds before you make any payments.

Many consumer money transfer providers, on the other hand, provide access to more currencies via a single IBAN, but each currency is held in a separate wallet that needs to be topped up before each transfer.

Both options are inefficient and costly due to transfer fees and fluctuating FX rates. So it’s important to consider if a provider has:

- A reliable solution for accessing multiple currencies that keeps your payments and reconciliations simple.

- Hands-on customer support in case something goes wrong or you need help navigating complex transfers.

Why IFX is a great solution for paying overseas suppliers

With over 20 years of experience in payments and a 4.5-star Trustpilot rating, we ensure that SMEs receive dedicated support to help SMEs simplify their overseas payments. Our platform offers solutions for efficient and cost-effective supplier payments. Here’s what you can expect when working with us:

Ensure every payment reaches its destination with hands-on customer support

As an SME dealing with overseas payments, you don’t want to find yourself stuck trying to resolve payment issues for weeks on your own.

We know how costly and frustrating this can be, which is why we focus on proactively reaching out to ensure clients know what support is available. For example, if a payment gets blocked for some reason, we won’t just send a notification. We’ll reach out to you by phone or email and let you know the issue. This way, you always know what’s happening with your payments, and unnecessary delays are avoided.

If you run into issues like delayed or failed supplier payments, you can always reach us by phone or email for quick and efficient help.

Simplify overseas payments with one multi-currency account

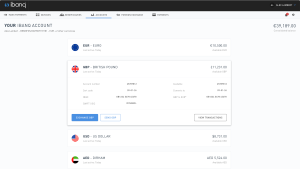

Example of a multi-currency account within IFX’s interface

Banks and mass market fintech providers typically require separate accounts or wallets for each currency and for each one to be funded before payments can be made. IFX, on the other hand, offers a single multi-currency account with one IBAN that lets you make mass supplier payments in over 60 currencies and collect funds in over 40.

You don’t have to worry about converting funds into the supplier’s local currency before the transfer. For example, you can hold funds in GBP and send payments to recipients with other currencies. This cuts down on administrative work and conversion fees.

Plus, with one IBAN, reconciliation is easier and takes less time. You don’t have to track money across multiple accounts, export reports from each, and manually enter the data into your main system for auditing. It’s also much simpler to invoice. Regardless of currency, all your international invoices can have the same bank details. This saves time, streamlines your international invoice workflow, and reduces the risk of errors.

For even greater flexibility, our multi-account setup lets you open and manage unlimited sub-accounts, all accessible from one centralised platform. This makes it easy to group suppliers by type or region for smoother tracking, payments, and reconciliation.

Pay multiple suppliers faster and more accurately with our mass payment solution

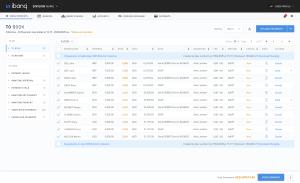

Example of IFX’s mass payment interface

Instead of paying suppliers manually, one by one, our solution lets you pay them all in one go through a single CSV file upload. You simply fill out a spreadsheet using our template and upload the file. Our system automatically validates each entry in real time, flagging any errors before processing. Currency conversion is handled automatically, so individual FX trades don’t need to be made for each transaction.

If you have to make recurring payments to suppliers each month, you just need to update the amounts and reupload the spreadsheet.

For even greater efficiency, our payments scheduling feature enables you to set payments for a specific date and time. You can even lock in favourable exchange rates for more control over your FX costs.

See exactly what you’re paying with our transparent fees

High fees make a significant dent in your business margins. At the same time, opaque or complex pricing makes it hard to predict your costs.

To make managing costs and planning easier, IFX prioritises transparent rates and fees. We inform you of all pricing charges upfront, so you can better understand your costs.

Our pricing is also tailored to your needs. We’ll work with you to find a pricing structure that makes sense rather than locking you into a rigid one-size-fits-all plan. And we don’t impose payment limits on what you can send or receive (however unusually large payment activity may be flagged) or additional charges without agreeing these with you upfront.

We understand that currency fluctuations stemming from world events can contribute to losses. Having predictability and control is important. One thing that can help is having a better understanding of what’s going on in the world, so we provide market updates for your information. Our corporate FX service also lets you lock in a currency rate for a future date, when paying for identifiable goods and services, with a view to saving money in the wake of currency fluctuations.

Additionally, holding funds in specific currency accounts avoids constantly having to convert between currencies to make supplier payments. It also gives you control over when you convert your funds, so you can take advantage of good rates or avoid unfavourable rates.

How two companies simplified overseas supplier payments with IFX

We aim to help cross-border payments run more smoothly. Here’s how two different companies streamlined their overseas supplier payments (and more) with IFX.

The ecommerce company that cut FX costs and cleared payment delays

A small ecommerce company selling its products globally was making regular payments to overseas vendors (based in China) and receiving revenue from its global sales.

The company faced two major issues. First, when working with a large, well-known transfer provider, incoming payments were often delayed, sometimes taking four to five days to reach its account, with little visibility as to why.

Second, high FX costs were eating into their operating margins, and fluctuating rates meant the company was often not breaking even.

We helped the company lock in consistent FX rates for supplier payments, saving money and giving the team more predictability and control over costs. Our multi-currency accounts and mass payments ensured greater visibility and faster access to funds.

With IFX, the company’s payments became more affordable, predictable, and efficient, helping it stay focused on growth, not payment delays and FX complexities.

The investment firm that gained better control over client payments

An investment firm working with high-net-worth clients needed to manage incoming and outgoing funds more efficiently. The firm received money from clients, invested it on their behalf, and then paid them the proceeds.

To simplify the firm’s payments, we provided our multi-account solution. This enabled the firm to open up multiple sub-accounts for each client under a single umbrella account. Client transactions could be processed and tracked by the client separately, with funds segregated in the sub-accounts for easier management and reconciliation. At the same time, everything was accessible through a single convenient interface.

With IFX, the investment firm was able to simplify client management and payments without the hassle and without the costs involved in separate account setups.

Make speed, savings, and support a priority for your overseas supplier payments

As a fast-growing SME, you need a reliable way to make fast, and cost-effective supplier payments. At IFX, we specialise in international business payments and have experience working with businesses across a range of verticals including shipping, travel, and ecommerce. So, we have the infrastructure and solutions to keep the entire process efficient.

We also understand the challenges SMEs navigate when dealing with overseas payments, which is why we take a unique, service-first approach. With us, you can be confident that you have dedicated customer support every step of the way.

The contents of this article do not constitute financial advice and are provided for general information purposes only. Links to third-party websites are included for convenience only, and IFX Payments holds no responsibility for the content, services, products, or materials on those sites.