If cross-border payments are a regular part of your business operations, you’ll need a way to send and receive money in a simple, cost-effective way. Your first option might be to open a foreign currency account with a traditional bank or a bank account in another country. But, in doing so, you might find that:

- Opening a business account with a UK bank takes four weeks to three months.

- While you might want to separate your funds by client, region or use case, sub-accounts aren’t offered by traditional institutions.

- Banks aren’t always transparent about their costs. “Research shows that some banks still hide the bulk of the cost of a transfer in an inflated exchange rate.”

- Equally, you’re being hit by potentially high FX markups. For example, banks pay a certain amount for a currency but they sell you the currency for a completely different rate (often 2% to 5% worse than what they’re paying). These rates can chip away at your profit margins and make it hard to forecast or manage your costs.

- Payments are sometimes slow (often take two to five business days to settle).

- Support is insufficient. Small business owners are left to navigate impersonal call centers and clunky online portals.

Faced with these challenges, many SMEs find that a virtual IBAN (or VIBAN) offers greater control, flexibility, and transparency. However, choosing the right virtual IBAN provider will depend on your specific needs. To help you find the right fit, this article will cover:

Ready to get started with a virtual IBAN right away? Book a call with us

When does it make sense to use a virtual IBAN (compared to a standard business account)?

A virtual IBAN is an efficient way of sending and receiving international payments via a single account. Compared to a traditional bank, it offers more flexibility, greater control over your inbound currency conversions, and has the potential to simplify reconciliation, allowing you to save time, reduce costs, and streamline your processes.

So, when does it make sense to use a virtual IBAN? Here’s a breakdown of some of the use cases where a virtual IBAN might serve you better than a traditional international bank account.

You’re making and receiving cross-border payments in multiple currencies

Traditional business bank accounts typically have limited currency options (usually GBP, EUR, and USD). These accounts must be opened and managed separately, which can be time-consuming since you’ll have to juggle multiple account details.

On top of that, funds received in different currencies may be automatically converted, meaning you may have less control over the exchange rate used. A multi-currency virtual IBAN lets you receive multiple currencies easily without the risk of inbound conversion because you can hold the currency in one of your currency balances. This helps you avoid losses.

You need to separate funds for different purposes

With a traditional business bank account, you need to open separate bank accounts to keep funds organised by region, brand, or purpose. Whereas with some virtual IBANs, you can create sub-accounts under a single master account. This gives you the flexibility to separate payment flows for payroll, invoicing clients, and more, without the hassle of managing multiple bank accounts.

You want to scale overseas quickly without setting up a new account in each market

If you’re expanding into different countries, having to set up new business accounts in each market can be complicated. Complex onboarding requirements often mean the process takes weeks, limiting your ability to scale. In contrast, virtual IBANs can usually be opened much faster. Some providers (like IFX) make onboarding clients efficiently a priority. This makes it easier to expand into new jurisdictions and manage your funds more effectively.

You want more flexibility and control over your cross-border payments

Traditional banks may rely on manual processes, one-size-fits-all pricing and outdated platforms. Together, these can make for a more clunky experience. Virtual IBAN providers typically offer modern interfaces that let you set up additional IBANs with ease. Some businesses need to open sub-accounts for several different reasons with unique IBANs. Having these accessible from the same platform can assist with reconciliation. This level of agility and control helps keep cross-border transactions efficient. It also lets you adapt quickly as your business scales.

The issues of using a mass market fintech provider

Mass market fintech providers are well-known, consumer-focused, accessible solutions. They make it easier to receive payments globally without opening accounts in each country. This is because platforms are user-friendly and they convert money from one currency to another, usually at competitive rates.

They may also offer fast onboarding and simple tools like apps to simplify reconciliation and tracking. This makes them a natural port of call for SMEs looking for a better solution for their cross-border payments. However, they also come with some downsides that especially affect SMEs.

One-size-fits-all pricing makes it harder to manage costs

These providers typically offer fixed, volume-based pricing. So, while costs are low if you’re making occasional international transactions, they can quickly add up as you scale.

Lack of personalised service, which causes issues when payments get stuck

Mass market fintech providers are typically low-touch. This means customer support is usually via chatbots, help docs, or long support queues. If you’re an individual or a business with fairly standardised needs this level of support may be enough. But if you’re an SME with high volumes of cross-border payments, you need dedicated customer service to resolve payment issues.

For example, imagine you’re paying £500,000 to a provider and they get in touch to say the payment hasn’t arrived on time. You don’t want to have to fill out a support ticket and wait for a response. You want to pick up the phone, speak to someone who knows and understands your business, and work out what the problem is.

Industry and business restrictions mean your company may not be able to access them

While mass market fintech providers are accessible to many businesses, some types of businesses may not be supported or face certain restrictions. If your SME falls under these categories, you may experience onboarding challenges or find that their services are unavailable.

5 questions to ask when choosing a virtual IBAN provider

Choosing the right virtual IBAN provider can make a real difference to how efficiently you move money across borders. Below are five key questions to help you find a solution that fits.

1. Do they offer efficient virtual IBAN setup?

A key advantage of virtual IBANs over traditional bank accounts is a more efficient setup. In theory, opening a virtual IBAN should be quicker than opening an account with a traditional bank, but there may be variation in timelines from different providers. It’s important to check what the process is so you know what to expect.

For example, do you need to go through full onboarding for each new IBAN, or can you get one set up with minimal effort once you have a master account?

2. Do they provide multi-currency IBANs?

The right provider lets you receive payments in multiple currencies in one account. That way, you don’t have to open and manage separate currency accounts or worry about extra admin or conversion costs.

3. Do they offer competitive and transparent pricing?

It’s important to understand the costs of using a virtual IBAN provider upfront. Do they charge set-up fees or monthly fees? Most providers will charge a fee for each additional sub-account you open, so you will want to know how much it’s going to cost to open sub-accounts in different currencies, clients, or regions.

Next, is pricing tailored to your business, or are you placed in a generic pricing band based on transaction volume? A good provider will take the time to understand your business model and offer pricing that fits with your cross-border payment strategy.

4. Do they give you visibility and control over your payments?

A good provider will make it simple to view key payment information, for example, via an online dashboard where you can view the status (such as , ‘awaiting approval’, ‘awaiting settlement’, etc.). Ideally, they should also support multiple payment networks, such as SWIFT, SEPA, or Faster Payments and let you choose the best option for each transaction. That way, you avoid unnecessary payment fees or delays.

It’s also important to check how they handle payment errors or delays. Crucially, ensure they can provide clear communication when issues arise. Some providers have been known to freeze transfers or your entire account without warning or explanation, with customers in some instances reporting “being left in the dark and having difficulty getting answers or assistance.”

5. Do they provide personalised support and an account manager?

When you encounter delayed or blocked payments or other account issues, you need to know that you can speak to someone directly. Some providers only offer low-touch options that leave you waiting days for a response. The right provider offers personalised support and an account manager. This ensures you can resolve issues quickly and keep your global payments running smoothly.

Why IFX is a good virtual IBAN provider for UK-based SMEs

IFX is authorised and regulated by the FCA and takes a service-led approach to cross-border payments. We help SMEs across industries such as ecommerce, travel, and shipping simplify their cross-border payments. Here’s why we’re a good fit for UK-based SMEs looking for a virtual IBAN provider:

Start sending, receiving and holding in 40+ currencies

Onboarding with banks can take weeks. At IFX, we aim to get businesses onboarded as efficiently as possible. More complex business profiles may take longer, but we’ll keep you informed at every stage. During the KYC process you can also ask questions and join demos.

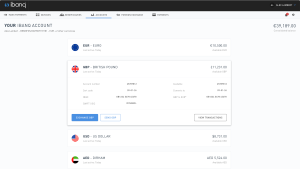

Assuming you have asked for multi-currency accounts, once onboarded, you gain access to a multi-currency account with one IBAN, allowing you to send, receive, and hold funds in over 40 different currencies. All your funds are available under a single dashboard, simplifying invoicing, financial management, and reconciliations.

If you want to organise your company funds within your account, you can open up to 1,000 sub-accounts, each with its own IBAN. That way, you can split funds by region, client, or business use without having to set up and manage lots of local bank accounts. This gives you greater control over how your funds are organised and helps simplify your financial operations.

IFX multi-currency account dashboard

Stay in control of your costs with clear pricing

High fees can put pressure on your margins, while opaque pricing makes it hard to predict your costs. Our competitive FX rates can help reduce costs. Our aim is to be transparent with the transaction fees we charge so you know what you’re paying and can manage your costs more effectively.

Rather than one-size-fits-all pricing, we offer bespoke pricing based on your business, industry, and growth plans. For example, if you’re an SME in supply chain trade, financial services, or shipping, foreign exchange rates may be more important than fees because you work with multiple cross-border partners and convert large volumes of currency.

Ensure smoother cross-border payments with personalised support and dedicated account management

If cross-border payments make up a key part of your business operations, they need to run smoothly. But if you can’t access support, issues can drag on for days, leading to costly delays and operational disruptions. With a 4.5-star Trustpilot rating, we provide personalised support to every client, so you’re never left chasing help when something goes wrong.

You’ll have a direct line to an account manager. No generic support queues. Just help from someone who understands your business. And if something goes wrong, you won’t be left chasing. Your issue will be picked up and resolved as quickly as possible.

Our customer service extends beyond issue resolution. We provide market updates to give you important insights.

Choose a virtual IBAN provider that offers flexibility, tailored pricing, and personalised support

As an SME, traditional bank accounts can make international transactions slow, fragmented, and expensive. With a virtual IBAN, you can speed up payouts, cut conversion costs, simplify reconciliation, and gain better control of your international operations.

The right solution will also make it easy to organise your funds, control your costs, track your incoming payments, and resolve issues quickly so you can focus on growing your business, not chasing payments. Personalised support is also crucial for keeping your global payments running smoothly.

And finally, the right provider will take the time to understand your business. They’ll work with you so you can get the most out of their functionality, tailor their pricing to your needs, and help you simplify your cross-border payments.

If you’re an SME wanting to simplify your cross-border payments, we can help. Book a call with us today.

The contents of this article do not constitute financial advice and are provided for general information purposes only. Links to third-party websites are included for convenience only, and IFX Payments holds no responsibility for the content, services, products, or materials on those sites.