If you’re regularly processing large volumes of business payments, be it to suppliers or employees, you know that:

- Making individual payments one at a time across thousands of individual transactions takes up hours that could be better spent on other areas in your business.

- Dealing with multiple currencies increases your exposure to FX fluctuations and fees, driving up your aaapayment costs.

- Payments can take days or weeks to clear, with little visibility on where the payment is in the clearing process.

- If payments fail, get delayed, or go missing, it can be hard to get through to a human to help you. Instead, you’re stuck trying to figure it out on your own through documentation, FAQs, and self-service portals.

If any of the above rings true, you’re probably looking for a bulk payment (also known as mass payment) system to help address some of those issues. In this article, we’ll help you understand:

- The challenges of bulk payments as a Small and Medium-sized Enterprise (SME)

- What to look for in a bulk payment solution

- How a bulk payment solution works (using IFX as an example)

- Why use IFX for bulk payments?

- How a global fashion brand consolidated and simplified bulk payments with IFX

Note: Looking to get started with a bulk payment system? Book a call with our team to learn how IFX Payments can help you.

The challenges of bulk payments as an SME

To successfully evaluate a bulk payments solution, you need to understand the specific challenges. Here’s a breakdown of the most significant.

Manual payments increase errors and lead to failed payments and lost funds

Making a high number of payments in one go is a hugely cumbersome process. Your payment manager needs to log into a banking platform, manually create each recipient profile, enter bank account details, add the payment amount and currency, and then schedule or send the payment.

And then repeat for every payment.

For one or two payments, this is relatively simple. But when you’re processing 50, 100, or 1000s of payments, it becomes time-consuming and can take an individual or small team days or even weeks to complete.

The tedious nature of the task also increases the likelihood of errors such as typos, incorrect payee details, or missing information — which you only find out about once you’ve made the payments. This increases the risk of failed payments, delays, and lost funds that require additional time and resources to resolve, potentially leading to cash flow issues and unhappy customers.

Managing multiple currencies is complex and expensive

Manually processing mass payments can quickly become overwhelming, especially when you’re making payouts across borders.

Imagine, for example, that you are a payroll company making salary payments to 300 recipients across 10 different countries. Beyond the time-consuming process of entering payment details for each payee, you also have to manage foreign exchange for each one. This means converting funds into 10 different currencies at various rates across each bank account. Plus, the complexity of dealing with foreign exchange for hundreds of payments also increases the risk of errors and payment issues.

Fluctuating exchange rates, fees, and transfer costs add further complexity. You have to factor in payment processing fees and exchange rates for each payment. These fees can quickly add up, significantly increasing your payment costs.

On top of that, like many SMBs, you’re likely to face limited support from your bank or fintech service provider because you’re seen as too small to prioritise. This can leave you stuck trying to resolve an issue for weeks, resulting in late payments, strained relationships with your employees and suppliers, which can further damage your margins.

What to look for in a bulk payment solution

A bulk payment solution simplifies the arduous process of making multiple payments one by one. You can pay thousands of recipients at once, making it easier to manage large-scale payments like global payroll or supplier payments.

For your business, this means faster payments and more time to focus on strategic work. However, not all these services are created equal. Here’s what to look for in a bulk payment solution:

Enables one-time bulk upload of mass payments

A bulk payment solution should allow you to automate your batch payments so you don’t have to waste days each month doing it manually, line by line.

In terms of functionality, look for:

- Features such as batch payments via CSV uploads or ERP-connected APIs to automate repetitive tasks and minimise the risk of human error.

- Error checking and validation to reduce the likelihood of errors and failed payments.

- Real-time tracking and reporting for more transparent and visible payments.

- Strong security and fraud prevention features to safeguard against unauthorised access, such as two-factor authentication.

Lets you pay in multiple currencies quickly and easily (ideally with one IBAN)

A bulk payment solution should allow you to make payments conveniently in a broad range of currencies. However, not all bulk payment services handle multi-currency payments in the same way.

Some solutions allow you to open multiple virtual accounts, each with its own IBAN, to make payments in multiple currencies. The issue with this is that it becomes hard to see all your funds in one account (since they are scattered across multiple accounts). This can make it difficult to reconcile and keep track of your funds across all currencies.

For example, with a tool that requires you to open multiple currency accounts before making payments, you’ll have to check if you have sufficient funds in the account for each currency. If not, you will need to fund these individually. Not only is this time-consuming, but your foreign exchange costs will quickly add up because you’re constantly having to exchange to multiple currencies.

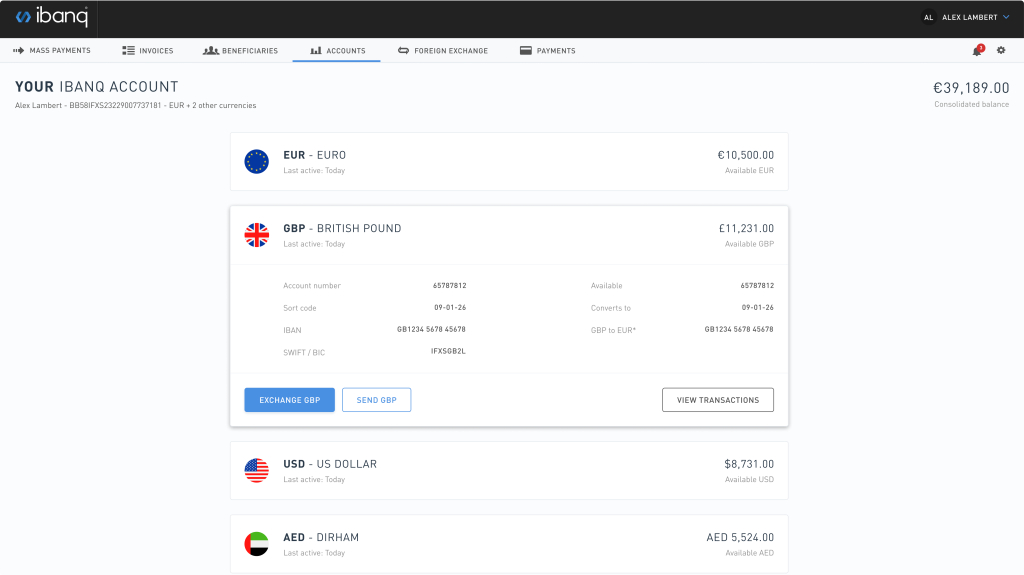

A better solution is to have a single account, with one IBAN, for all your cross-border payments. Unlike multiple virtual accounts, one IBAN lets you see and manage all your currencies and payments from a single interface.

You can also make payments without worrying about whether you have enough money in each account. This reduces administrative tasks and saves money on currency conversion and top-us.

Provides access to a dedicated expert when you have payment issues

Bulk payment processing can be complicated. When you factor in multiple markets and currencies, delays and payment failures can occur due to errors like incorrect or missing beneficiary details. While low-touch or no-touch support models are the norm for major providers, self-service portals and chatbots won’t cut it when you’re caught between failed payments and disgruntled suppliers.

Consider this scenario: You’ve created a pay schedule for your remote employees or freelancers based in another country, but it gets delayed by several days. Employees are rarely able to wait a few extra days, and the delay causes serious issues for them.

The last thing you want is to wait hours for a chatbot to escalate your issue, only to spend days getting passed between unhelpful support agents. You need to be able to pick up the phone and speak to a real person quickly to resolve the issue.

So, when looking for a bulk payment solution, make sure you can always reach someone to help you solve compliance issues or foreign exchange-related concerns.

How a bulk payment solution works (using IFX as an example)

At IFX, we designed our platform to provide a more flexible and service-led alternative for managing cross-border payments. Based in the United Kingdom, and regulated by the Financial Conduct Authority (FCA), we offer bespoke foreign exchange services, multi-currency accounts, and bulk payment solutions to support global businesses with their operations.

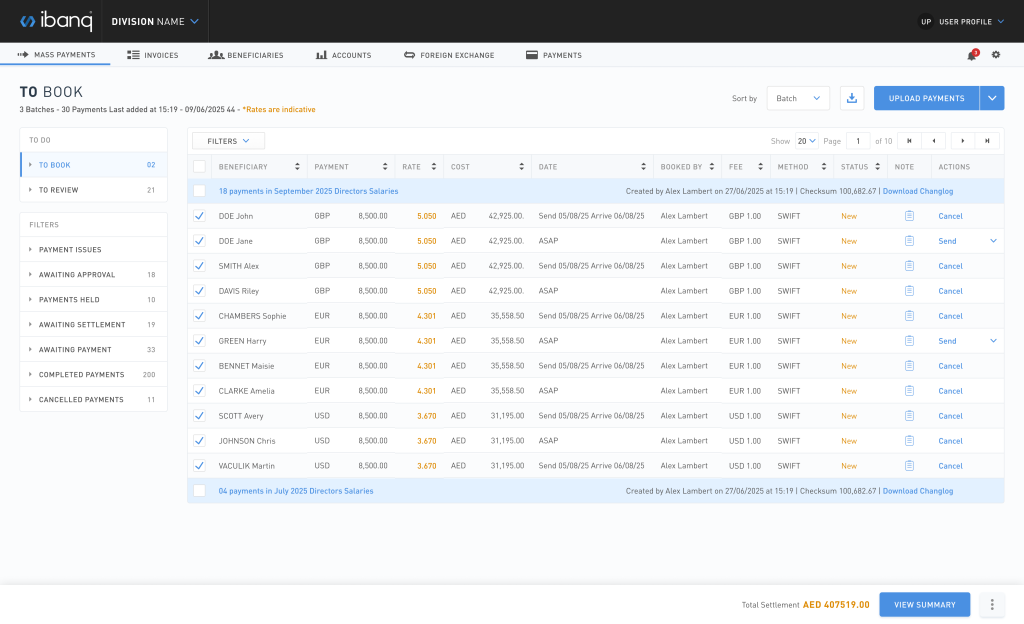

Here’s how you would use IFX’s solution to disburse payments to 25 suppliers quickly and conveniently through a single bulk payment file upload:

- Log in to IFX’s dashboard and navigate to the mass payments tab.

- Then, using the provided spreadsheet template, you can enter payee details such as:

- Beneficiary name

- Unique reference

- Address, city, country, and postcode

- Payment currency

- Bank name and country

- Account number

- Swift/BIC, IBAN, or other routing numbers

- Telephone number and email

- Email settlement reference

- Amount

- Send-on and arrive-by dates

- Transaction method

- Once filled in, upload the CSV file.

- Our system validates each payment line by line and flags any errors, for example, ‘Payment validation failed on lines 10, 21, and 25’ along with a reason, such as ‘wrong sort code’ or ‘invalid account number’.

- After fixing these errors, resubmit the spreadsheet and initiate payments. We process the payments to suppliers, automatically doing currency conversions and ensuring the best pricing.

- You’re now able to track the progress of every payment and pick up any problems immediately. You can reach out to us at any time for help.

- In this example, the 25 suppliers receive their payouts in a matter of hours, not days, and in their preferred currencies.

- If you need to pay the same suppliers again the next month, you can simply amend the payment amounts and reupload the CSV, instead of starting from scratch.

Example of IFX’s bulk payment interface

Why use IFX for bulk payments?

Here’s what you can expect when you partner with IFX.

Simplify multiple payments with bulk uploads or via an API

Our bulk payment solution automates the manual effort involved in processing multiple payments. Through a simple bulk upload, you can group multiple payments together and send them out for processing in one go.

What typically takes your payment team days or hours to work through can be done in minutes, enabling them to focus on more strategic work like supplier management.

The process is as easy as entering payment details into a spreadsheet (using one of our templates) and uploading it to our platform. The system automatically flags any errors and tells you how to fix them, helping prevent failed payments even before they’ve been attempted.

When making recurring payments to suppliers and employees, simply update the amounts and reuse the same spreadsheet every month. You can also schedule payments for a specific date and time, making the process even more efficient.

Beyond bulk uploads, we offer bespoke API integration, allowing you to send bulk payment calls from your backend to ours. If you want to go down this route, our implementation team will provide hands on onboarding support to ensure the integration runs smoothly from day one.

Make bulk payments in over 60 currencies from one IBAN

Doing a bulk upload saves time, but if you still have to add funds to various multi-currency accounts and manually do currency exchange, the process can still take a long time.

With IFX, you can make payments in over 60 currencies and receive money in over 40, all from one IBAN. Simply specify the destination currency for each payment within your spreadsheet, and our system automatically handles each conversion from GBP.

To illustrate this, let’s say you have a thousand employees in Italy who need to be paid in EUR and a hundred in multiple locations who need to be paid in USD. Our system will process the conversion from GBP into these currencies automatically, line by line, and pay them out, using the interbank change rate of the day.

This eliminates the manual effort of individually calculating rates, doing foreign exchange for each currency, or managing multiple currency accounts. It’s all done for you, ensuring fast, reliable payments to local banks in any country that’s not sanctioned.

Cross-border transactions can be expensive, especially when dealing with harder-to-reach jurisdictions. Payout solutions, like the one provided by IFX, offer a cost-effective alternative with FX rates that are 2–3% lower than those of traditional banks. They also reduce administrative hassle and help you optimise workflows across departments — particularly in high-volume scenarios like rebates, affiliate commissions, checkout disbursements, gig economy payouts, or e-commerce vendor payments.

Example of a multi-currency account with IFX’s interface

Get support from a dedicated account manager who understands your business

We know that one-to-one support and fast response times are crucial when dealing with time-sensitive payments.

With a 4.5-star rating on Trustpilot, we’ve shown that personalised support is key to what we do. Our support teams will work closely with you to understand your business, objectives, and specific pain points.

From your initial sales call onwards, you’ll be assigned a dedicated account manager who understands your industry. Rather than being transferred between different support staff, you’ll build a lasting relationship with a dedicated expert who knows your name and your business. This continuity is key to building trust and ensures you always have a reliable point of contact.

So, whether you’re making payments, experiencing an issue with the platform, or trying to figure out the best time to send funds based on currency fluctuations, expert-level support is always just a call, email, or message away.

See where your payments are at every stage of the transfer

When you’re making a large volume of disbursements at once, not knowing where they are or if they’ve successfully cleared can be stressful. This lack of visibility means issues can go unnoticed for days, resulting in delays, bounce-backs, or lost funds.

With payment tracking, you can monitor the progress of your payments and see what stage they are at. That way, if there’s a problem, you can spot it immediately and reach out to us for help.

Whether it’s an error or a compliance issue, we’ll work with you to resolve the issue quickly before it leads to late payments. And while this is going on, you’ll be able to keep your suppliers and employees updated, helping to maintain trust.

How a global fashion brand consolidated and simplified bulk payments with IFX

An international fashion brand with stores, suppliers, customers, and employees all over the world wanted to pay their employees and contractors on time every month.

But with five different providers managing their payments, this was proving to be a complex and inefficient process. Every time payroll came around, it required an entire team to coordinate between each local payment provider, with different exchange rates, which increased costs.

The brand was attracted to IFX because of the speed, convenience, and global reach of our bulk payment solution. So, they partnered with us to ensure their employees, suppliers, and customers are paid on time. They also consolidated their accounts into one IFX account, opting for the ease of a multi-currency account over the hassle of juggling multiple providers.

They were able to spend fewer resources on managing multiple accounts and making payments manually, freeing up time for more value-add activities. They also saved money on all the various fees and currency exchange.

Choose a bulk payment solution that helps you scale

If you’re making large volumes of international payments, you need a bulk payment solution that’s easy to use, saves time, and ensures reliable global access. At IFX, we offer a bulk payment solution designed to meet those needs, plus dedicated support, to help you scale.

With 20 years of experience and the backing of a Tier 1 bank, we don’t just streamline your bulk payments, we deliver a complete foreign exchange and payments solution.

Whether it’s our multi-currency account (where you can collect over 40 currencies without any inward conversion risk) or through our bespoke foreign currency services, we’re here to provide value you can trust, every step of the way.

The contents of this article do not constitute financial advice and are provided for general information purposes only. Links to third-party websites are included for convenience only, and IFX Payments holds no responsibility for the content, services, products, or materials on those sites.