It’s the end of the month, and it’s time to pay your international employees. If you do this manually one by one via your bank, you’ll know how tedious it can be, often taking your team several days to complete. Under these conditions the chance of errors increases significantly, which can lead to delays or failed international payments.

Often, if there is an issue, the first thing you’ll know about it, is an employee chasing a late payment.

Additionally, you might find your bank is selling you a currency for a “completely different rate (often 2% to 5% worse than what they’re paying)”. This might be standard practice so banks can cover their costs, but the result is that paying international employees the same amount each month becomes more expensive.

If you’re expanding into new markets or looking to further expand your global workforce, these challenges can seriously stunt growth. Considering all this, you might be wondering:

How can I make paying international employees more cost-effective and reliable?

The right solution for you will depend on several key considerations. To help you make the right choice, this article will cover:

- Common international payment solutions + and their challenges

- Why you should consider using a specialised cross-border payment provider (and how to make the right choice)

- Why IFX is a good fit for UK SMEs wanting to pay international employees

- How a yacht company simplified its global payroll with IFX

CTA: Want to get started with a reliable solution for paying international employees? IFX can help. Book a call with us.

Common international payment solutions (and their challenges)

Banks, mass-market fintechs, and payroll providers are the common options available for paying international employees. However, each presents its own challenges for SMEs, especially those without a local presence in that country or a registered legal entity abroad.

Banks: High costs, slow payments, and heavy admin

Banks are often the first place to turn for international payroll since you will already have a business bank account set up and a relationship established. However:

- Costs can be unpredictable: Banks and other providers “hide sneaky charges in inflated exchange rates and never tell their customers.” This makes it difficult to project FX costs.

- Manual processes are time-consuming: Having to pay multiple employees line-by-line wastes time and increases the risk of errors leading to failed payments.

- Support may be limited for SMEs: Not qualifying for premium service tiers, often due to a smaller payment volume, means “small business owners are left to navigate impersonal call centres, clunky online portals, and long wait times”. This makes it harder to address delays, resolve payment issues, and get employees paid on time.

Mass market fintech providers: Easy setup, lower fees, but poor reliability

Mass market fintech providers are a great option for individuals or SMEs looking to make occasional international payments. They support multiple currencies, can be easy to set up, and tend to come with lower FX rates and fees than banks. However:

- Cost can be unpredictable: Tiered subscription models can end up being expensive. You might begin on a plan with a set transaction limit, only to find you need to upgrade to reach higher limits. Costs can creep up, and it’s not always clear what you’ll be paying from the start.

- Support is usually low-touch: With chatbots, FAQs, or slow email responses often the only support available, resolving account issues can be slow, leading to frustrating delays.

- Accounts and funds might be frozen without warning: Some reports have found that some customers have been “locked out of their accounts with no warning or explanation, leading to frustration and outrage.”

Payroll providers: Simplify HR but add costs and reduce control

Businesses turn to payroll solutions when they lack the time, resources or expertise to manage payroll services across different countries, especially when operating without a legal entity. In some cases, this includes working with an EOR (Employer of Record), which allows businesses to legally employ staff abroad without establishing a local presence. These providers typically calculate wages, manage tax obligations, administer benefits, and even support onboarding. While they offer a way to reduce administrative burden and avoid mistakes, such as misclassification, they can also:

- Add an extra layer of complexity: Coordinating with an external provider and integrating their systems often creates more admin.

- Increase your international employee payment costs: Outsourced global payroll fees are “around £3–£8 per payslip plus a monthly platform or service fee. For a 50‑employee company, that equates to roughly £3,000–£5,000 a year.” And, of course, as you grow, this figure will increase too.

- Reduce control and visibility: Working with a third party means less control and visibility over payroll systems and processes.

Why you should consider a specialised cross-border payment provider (and how to make the right choice)

Specialised cross-border payments providers (like IFX) are designed to streamline payroll systems. They offer key benefits such as:

- Lower, predictable costs: Transparent FX rates and flexible pricing tailored to your business help you keep global payroll expenses under control.

- Reduce the likelihood of mass payment errors: Bulk uploads and payment scheduling give you more control of payments and help ensure overseas employees are paid on time each month.

- Simple multi-currency management: Hold, pay, and receive funds in multiple currencies from a single platform instead of juggling separate accounts.

- More responsive support: Get personalised help from account managers to ensure payment issues are resolved quickly.

However, not all specialised cross-border providers are created equal. Ask these three questions to help you pick the right solution for your business.

1. Do they give you control over your payment costs?

Let’s say you’re paying 20 independent contractors in USD each month. The invoice is $100,000. But once the money leaves your bank account, the bank adds a 3% transfer fee. That’s $3,000 every month. On top of that, the USD/GBP rate shifts slightly, and suddenly your global payroll costs are up ≃£4,000 from last month.

The right provider won’t just offer lower fees; they’ll give you tools to control your costs. You should be able to hold funds in USD, GBP, EUR (or any of the 40+ supported currencies on IFX’s platform), and choose when to convert. Some even let you lock in today’s rate for months, protecting your margins from fluctuations and removing guesswork from your forecasts. IFX (for example) offers forward contracts for the purchase of identifiable goods and services.

2. Can you manage all your currency payments in one account?

Imagine you’re paying teams in GBP, EUR, and AED. With a traditional setup, you’re logging into three different banking portals and cross-checking exchange rates manually. To avoid this, you want a provider that lets you send and receive payments in multiple currencies through one dashboard. This gives you a better oversight of your payments and makes reconciliation much simpler.

For even more control, look for the ability to open sub-accounts that let you separate payments by country, team, or project so you can organise your funds in the way that works best for your business.

3. Do they provide tailored and responsive support?

It’s the 29th of the month. You’ve sent $80,000 in payroll to your remote workers, and two employees flag that their pay hasn’t landed. You contact support. First, a chatbot. Then an auto-reply. Meanwhile, your employees wait unpaid.

With the right provider, this shouldn’t happen. Most will give you a direct line to your account manager who knows your business and can attempt to establish the problem quickly. In some cases, they’ll even be able to anticipate issues and help avoid delays before they occur.

Why IFX is a good fit for UK SMEs who pay international employees

At IFX, we have over 20 years of experience providing cross-border payment solutions. UK-based SMEs across industries like shipping, travel, ecommerce trust us to help them pay international employees efficiently. Here’s how we can simplify your international payroll:

Consolidate all your international payments and stay on top of costs with one multi-currency account

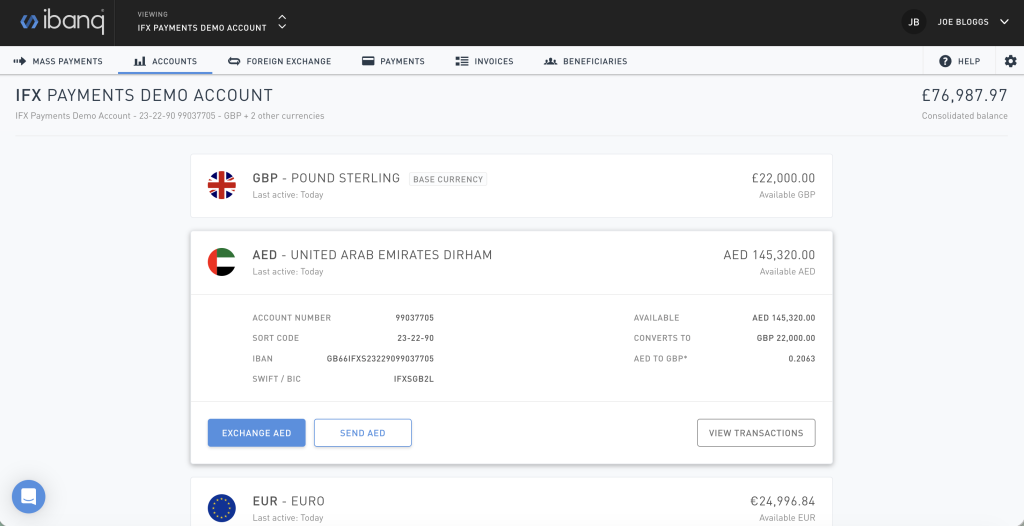

With IFX, you get a single multi-currency account with one IBAN, enabling you to pay employees in over 60 currencies all in one place.

You can organise your funds by region, project, or international team by opening up to 1000 sub-accounts under your main account. In this way, you can easily keep an eye on your payroll costs while retaining a centralised overview of all your funds, making reconciliation much simpler.

Our multi-currency IBAN also helps you save on conversion costs by letting you receive and hold funds in over 40 currencies. To give you still more control over your costs, we’ll create a pricing package that’s best suited to your business needs. Once this is agreed, we won’t change it without notifying you first.

Finally, we always aim to offer the most competitive pricing, helping you save on every international payment.

ibanq Multi-Currency Accounts page

Pay hundreds of employees in 60+ currencies with one bulk upload

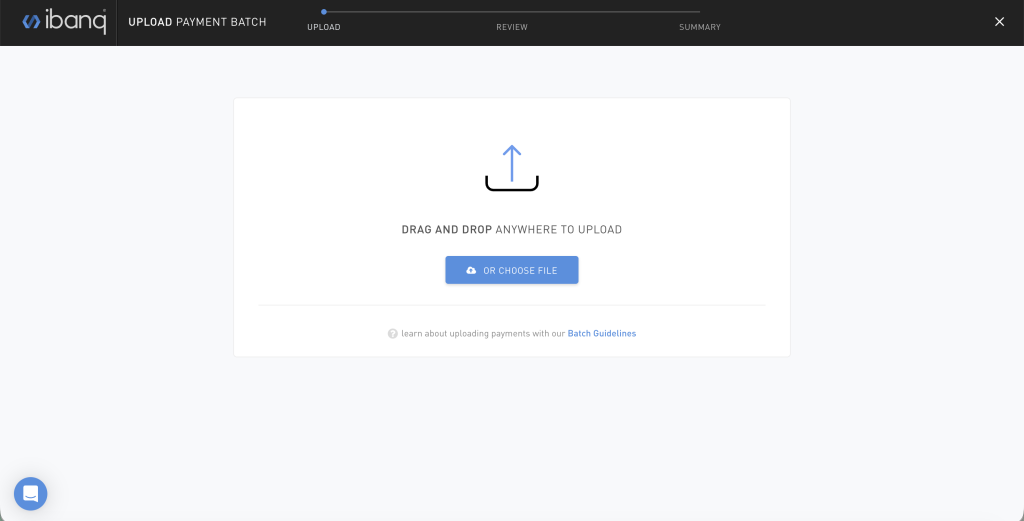

Paying employees one at a time is slow and error-prone. We help you automate the process, saving time and reducing errors with our mass payment solution.

For example, let’s say you employ 100 remote workers in Spain, Poland, South Africa, Canada, the US and the Philippines. Here’s how our mass payments function works:

- Download our CSV template and fill in payment details such as employee name, amount, local currency, IBAN or bank account number, and arrival date.

- Upload the file directly through our ibanq dashboard.

- Our system then validates each payment, flagging errors such as invalid account numbers or insufficient recipient details.

- For Faster Payments, a COP (Confirmation of Payee) check ensures that funds are being sent to the right recipient.

- FX is handled automatically within the batch, so you don’t need to worry about currency conversions and you’ll get an upfront quote before sending out a payment batch.

In this way, we can help you reduce your mass payment runs from days to minutes.

Upload CSVs to ibanq to begin mass payments

Keep employee payments on track with a dedicated account manager

Late payments create stress for your employees and for you. At IFX, we help prevent that with proactive, hands-on support.

You’ll work with a dedicated account manager who knows your business and gets things moving. For example, let’s say you send an £8,000 first salary to a new hire in Japan and it’s held up. Your account manager should be able to help identify the reasons for the delay. In this way, you don’t waste time navigating endless documentation and FAQ pages and in theory employees should experience less delays getting paid.

Plus, to ensure your cross-border payment strategy is optimised, your account manager will proactively keep you informed of market updates that might be relevant to you. In that way, you can identify opportunities to streamline your FX costs further.

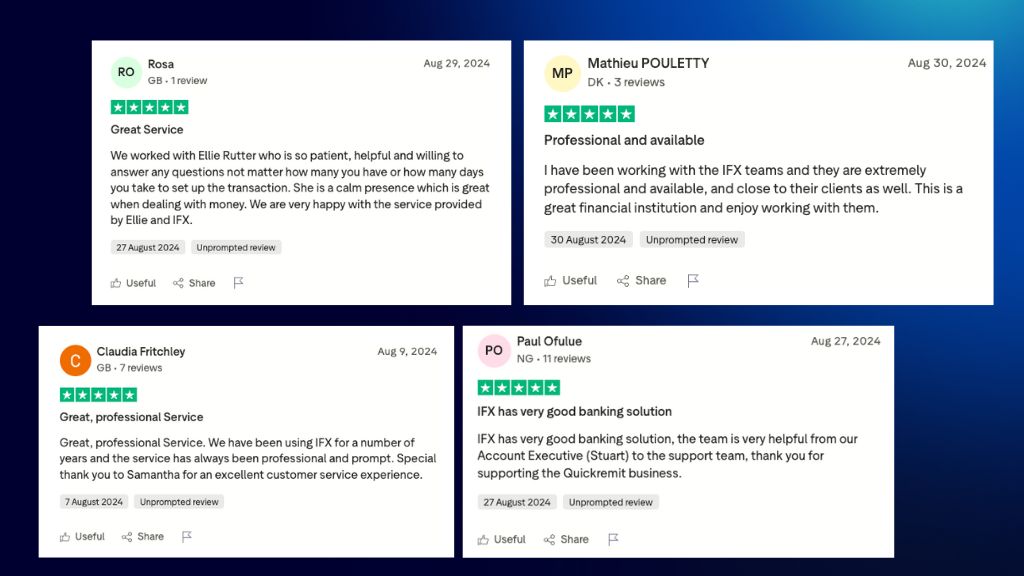

Some kind words from IFX Payments clients

How a yacht company simplified its global payroll with 150 sub-accounts

A yacht company with 1,500 international employees needed a way to streamline its in-house processes without having to set up a local entity in each jurisdiction. It also needed a way to keep funds and costs separate for each of its 150 yachts.

To help simplify its financial operations across the fleet, we provided a single multi-currency IBAN from which to make all payments. Within that account, we set up 150 sub-accounts so it could separate funds by different countries, teams, and vessels. We did this in just 10 days.

We also enabled role-based workflows to simplify payment management and provided ongoing support to resolve issues quickly. With IFX, the company can now run payroll more efficiently, reduce admin, and ensure its global workforce is paid on time.

Choose a provider that simplifies your international employee payments

You should be able to benefit from a global talent pool or enable remote work without losing hours each month to managing your global payroll. The right cross-border payment provider will allow you to:

- Quickly process hundreds of salaries across different currencies in one go.

- Pay out to 60+ currencies from a single IBAN.

- Save on conversion costs by receiving and holding funds in 46 currencies.

- See all payments in a single dashboard while also being able to organise your funds into sub-accounts.

Just as important, the provider should deliver a stand-out service, providing hands-on support to help ensure your cross-border payments run as smoothly as possible.

If you’re an SME looking to simplify your payment to international employees, book a call with us.

FAQs: How to pay international employees

How can I protect payroll from currency fluctuations?

By working with a provider that offers deliverable forward contracts, you can reduce risk in payroll from currency fluctuations. A deliverable forward contract lets you lock in a rate for a set period, so even if the market moves against you, your margins stay protected.

Are bulk payments cheaper than individual transfers?

Not necessarily. There may be fees associated with transactions to different jurisdictions meaning these could add up if you are making a large payment run with multiple destinations. However, the time savings you would make from doing all of these transactions in one go rather than individually is beneficial and may lead to cost savings across your business.

How long do international payments usually take?

International money transfers can take anywhere from a few seconds to several business days, depending on the countries, currencies, banks, and payment methods involved. Cross-border bank transfers typically take one to five business days, but delays can occur due to factors such as bank cut-off times, currency conversion, and the use of intermediary correspondent banks. A specialised provider, like IFX, can help speed up your international payments through user-friendly dashboards, dedicated support, and routing via robust global payment rails.

Is it cheaper to pay employees through banks or specialist providers?

It’s usually cheaper to pay employees through specialist providers. Banks often add hidden transfer fees and FX markups, while specialist providers typically offer more competitive exchange rates, transparent pricing tailored to your industry, and tools like deliverable forward contracts to help manage FX costs.

What financial risks come with paying employees internationally?

Paying employees internationally comes with several financial risks, including fluctuating exchange rates that make payroll costs unpredictable, hidden bank fees that increase expenses, and processing delays that can negatively affect employee trust. Working with a specialised provider like IFX will help you mitigate these risks through:

- Transparent pricing

- Tools like deliverable forward contracts

- Dedicated account managers who provide you with regular updates on FX market activity.

The contents of this article do not constitute financial advice and are provided for general information purposes only. Links to third-party websites are included for convenience only, and IFX Payments holds no responsibility for the content, services, products, or materials on those sites.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary, and customers agree to proceed at their own risk.