As a UK-based SME doing business globally, international business accounts can help you manage cross-border payments more efficiently.

But onboarding to a traditional bank can be slow, and you may not qualify for the competitive rates and tailored support that enterprise clients receive. As an alternative, you might consider a mass market fintech provider. But their large size often means they’re unable to provide the support you need to run cross-border payments.

Another solution is a specialist cross-border payment provider. And, while they might not offer a business bank account, or other products you would typically get from a traditional bank, such as credit, savings accounts and more, they tend to offer services more tailored to cross-border business payments.

The question is, how do you compare these different solutions? What features or capabilities should you prioritise, and how do you know which one is right for your business? To help you choose the most suitable solution, this article breaks down:

- Use cases for international business bank account or EMI alternative

- Top international business account alternatives

- Why IFX is a good fit for UK-based SMEs

- How a machinery exporting company simplified its cross-border payments with IFX

Looking to get started with a cross-border payment solution designed specifically for SMEs? IFX can help. Book a call with us today.

Comparison of international business account options for UK-based SMEs

| Category | Specialised cross-border solutions (like IFX Payments) | Traditional banks (like Lloyds and HSBC) |

Mass market fintech providers (like Wise, Revolut) |

| Best for | SMEs with specialised cross-border payment needs and large payment volumes | Enterprise businesses and SMEs with basic international payment needs | Individuals and SMEs with low cross-border payment volumes and standardised needs |

| Key features | – Multi-currency accounts – Sub-accounts – Bulk payments – Payment rail selection (SWIFT, SEPA, FPS) – Payment scheduling – Multi-user access |

– Access to financial products (loans, cards, deposits) – Limited currency support (GBP, USD, EUR) – Physical branch access |

– Wide currency support – Market-leading mobile apps – Virtual IBANs – Expense cards, multi-user access |

| Onboarding | – Can be as fast as a couple of days (IFX aim to onboard clients as efficiently as possible). – Demos and support during onboarding. |

– Can take weeks – May require in-person visits or physical presence abroad – May set large minimum turnover requirements |

– Fully digital and automated – In-app setup through mobile/web – Can be as little as hours and typically completed in days |

| Pricing | – Competitive FX rates – Tailored pricing based on business needs |

– Potentially higher rates on international transactions – Opaque and varied pricing depending on provider |

– Tiered or subscription pricing – Competitive FX, but fees can vary depending on volume, currency, and destination |

| Service | – Personalised support – Direct access to account managers |

– General support via phone, online, or in-branch – Dedicated service often reserved for large corporate clients |

– Mostly self-serve: chatbots, FAQs, and help articles – Account managers only on top plans |

| Potential drawbacks | – Not a full-service bank – Bank account still needed for loans and cards, etc. |

– Long onboarding timelines – High costs for international payments – Low pricing transparency – Limited visibility and slow issue resolution – Lack of tailored support for SMEs |

– Complex business types not supported – Transaction limits and fund holding restrictions – Pricing can increase without notice – Limited support for SMEs |

Common use cases of an international business account or EMI alternative

International business bank accounts and EMI alternatives should give you the tools to manage your cross-border payments more efficiently, whether you’re making money transfers or receiving funds. Here are five ways businesses might use these accounts, with real-world examples.

1. Manage overseas supplier payments

If you work with international suppliers, you need a solution that lets you pay in foreign currencies without excessive transaction fees or delays. For example, as a travel agency, you might collect bookings in GBP but need to settle with hotels or operators in Thai Baht or USD.

An ideal solution gives you access to multi-currency accounts and control over when you convert funds. This helps to keep currency exchange costs low, which improves profit margins.

2. Keep projects financially separate

If you have multiple projects or payees in different regions, you might find it helpful to organise your funds accordingly. For example, if you’re a film production company managing royalties, contractor payments, and expenses in USD, keeping funds separate is essential.

An ideal solution will let you create sub-accounts linked to each production or special-purpose vehicle (SPV). This makes it easy to track account details and repatriate funds. It also gives you better oversight and control across projects.

3. Pay overseas employees easily

If you run a business with employees or providers in multiple countries, you need a solution that lets you pay in multiple currencies quickly and cost-effectively. For example, as a shipping company, you may need to cover port fees, docking services, or crew wages in foreign currency, depending on where each vessel operates. The right payment solution will give you access to multiple currencies and efficient, reliable payments, helping you stay on schedule.

4. Control when you convert your currencies

If you’re regularly moving funds across borders, you’ll want to be able to control how and when you convert them. For example, as an ecommerce business selling in Europe, you might receive EUR or GBP. But if you source goods from Africa, you may need to pay suppliers in Nigerian Naira (NGN) or South African Rand (ZAR).

Ideally, you should be able to hold, convert, or manage these currencies in one place to support better cash flow and reduce costs incurred by unnecessary conversions.

5. Pay multiple international payees or suppliers at once

If you’re making monthly payments to a large number of payees or suppliers, you don’t want to be stuck doing this line by line. Some international business bank accounts and specialist cross-border providers allow you to make bulk payments to different recipients, all in one go.

Top international business account options

For UK businesses wanting to simplify their international payments, we’ve identified these top solutions:

- Specialised cross-border solutions (like IFX): Payment and foreign exchange solutions providing payment services, including multi-currency accounts and cross-border payment processing.

- Traditional banks: Licensed and highly regulated institutions (like Lloyds and HSBC) offering international business bank accounts at scale.

- Mass market fintech providers: Online platforms (like Wise or Revolut) offering money transfers and multi-currency accounts for individuals, sole traders, and freelancers.

Not every solution will suit your business model, industry, or growth stage. Below we compare the key features of each solution in greater depth, such as onboarding, pricing, service, and drawbacks, so you can make an informed decision.

Specialised cross-border solutions: Ideal for SMEs that regularly send and receive international payments

Specialised cross-border solutions (like IFX) are different from traditional business bank accounts in that they’re purpose-built to help small business clients manage international payments more efficiently. Compared to solutions that cater primarily to consumers, they typically support businesses across a wider range of industries.

Key features of specialised cross-border solutions include:

- Multi-currency accounts with sub-accounts: For efficient fund management, specialised cross-border payment solutions typically allow you to send, hold, and receive funds in multiple currencies (over 40 with IFX) under a single multi-currency IBAN. They also support separate sub-accounts under one profile, enabling you to separate and manage funds by supplier, region, or use case.

- Bulk payments: To simplify mass payments, these solutions typically support bulk payments via CSV upload. This lets you pay multiple recipients across multiple regions at once, saving time and reducing manual errors.

- Payment scheduling and tracking: For greater predictability and visibility over transactions, payment scheduling and tracking are usually available. These solutions also support multiple payment networks, including SWIFT, SEPA, and Faster Payment, for more control over payments. Some providers (like IFX) even give you the flexibility to pick the best network for faster, cheaper money transfers.

- Faster personalised onboarding: Typically smaller and more client-focused than banks, specialised cross-border payment providers often take a more personalised approach to onboarding. With fewer clients and a greater focus on specific business finance needs, they will likely have someone on hand to support new clients during the onboarding process. This often includes sales calls, onboarding support, and live demos. As a result, account opening and onboarding are typically faster and can be completed in days rather than weeks in some instances.

- Tailored and flexible pricing: Specialised cross-border solutions typically offer more cost-effective solutions than banks. As Edgar, Dunn & Co. state: “While traditional banks have been slow to adapt, fintech companies and specialised payment providers are stepping in with innovative solutions that offer faster, more cost-effective, and transparent alternatives tailored to SMEs.” Some providers (like IFX) also provide more flexible and tailored pricing, based on your industry, business model, and needs.

- Personalised service and dedicated account management: Typically built with business customers in mind, specialised cross-border solutions are usually more service-led. So, instead of relying on slow email support, chatbots, or self-help portals, you can pick up the phone and speak to someone when you have a money transfer question or payment issue. Some providers (like IFX) go a step further by offering dedicated relationship management for ongoing support.

Potential Drawbacks: Not a standalone banking solution for SMEs

Specialised cross-border solutions may be limited in the service they provide, depending on the type of licence they have. You’ll still need to use a traditional bank for credit cards, savings accounts and other financial services, so it’s not a standalone solution for all your business’s financial activity.

Who are they best for?

They are best for SMEs with complex cross-border payment needs and large payment volumes.

Specialised cross-border solutions are best if you regularly send and receive international payments. They’re ideal if you trade across multiple countries or jurisdictions, or if you want better control over how your cross-border payments are managed. They’re also a great fit if your business is focused on scaling and you want hands-on customer support.

Traditional banks: Ideal for enterprise businesses or SMEs that don’t make many international payments

Banks like Lloyds and HSBC offer international business bank accounts that support international payments, alongside broader financial services. Their solutions are well-suited to large enterprises and can also work for UK businesses that don’t process many money transfers.

Key features of traditional banks include:

- Broad financial services and trusted infrastructure: Traditional banks offer a broad range of financial services, including credit facilities, investment products, and the flexibility of physical branches. They’re also well established; they’ve been around for decades and are almost certain to be around for decades to come.

- Standard and premium service options: Banks typically offer specialist banking services and dedicated relationship managers for enterprise clients. But you typically need a high annual turnover to qualify. For example, HSBC offers “specialist banking services for corporate banking customers with a turnover above £15m,” and Lloyds “for businesses with a £100 million plus.” For businesses operating below these thresholds, standard non-personalised support is usually available through online banking platforms, phone, or in-person assistance.

Potential drawbacks: Slow, expensive, and not tailored to SMEs

- Longer onboarding with more requirements: Opening a UK business bank account “can take 4 weeks to 3 months”, often involving branch visits, and the possibility of additional checks by solicitors and accountants. Some banks may also require minimum turnover or local presence to open currency accounts.

- Not tailored to SMEs: SME clients are often too small to qualify for a business current account and often get assigned “generic products that may not align with the specific needs of SMEs”.

- High and unpredictable costs: It’s considered by some that “banks and other providers hide sneaky charges in inflated exchange rates and never tell their customers”. They may also charge maintenance fees, and credit or debit card fees. As your volumes increase, these costs can eat into your margins and limit your ability to scale. Additionally, unpredictable fees make it hard to understand what you’re being charged or manage your costs.

- Limited support: SMEs are often “left to navigate impersonal call centres, and clunky online portals”. Response times can vary depending on queue volumes, business hours, and internal processes. This can leave you chasing help when payment issues arise and result in late payments, delays, and operational disruptions.

- Limited currency options: International business bank accounts often support transactions in just two or three major currencies, like GBP, EUR and USD.

Who are they best for?

They are best for enterprises and SMEs with basic international payment needs.

Traditional bank accounts are best for large enterprises and SMEs with simple international payment needs. They work well if you don’t process high volumes of cross-border payments, don’t need greater control over your payments, or don’t require features like multi-currency sub-accounts or mass payments.

Mass market fintech providers (like Wise and Revolut): Ideal for individuals and smaller SMEs with standardised international payment needs

Mass market fintech providers like Wise and Revolut provide a range of digital-first international payment solutions to both individual and small business customers.

Key features of mass market fintech providers:

- Multi-currency support, mobile apps, and other tools for small SMEs: Mass market fintech providers typically support a wide range of currencies (25+ for Revolut and 22 for Wise). They offer mobile apps, virtual IBANs, bulk payments, debit cards, and multi-user access.

- Digital onboarding with fast setup: As virtual providers, with no physical branches, most mass market fintech providers offer fully digital onboarding. Platforms like Wise and Revolut have user-friendly apps which handle account setup in a few simple steps. Processing is typically automated, so onboarding (including eligibility checks and ID verification) can be completed in days rather than weeks.

- Lower rates and fixed pricing models: Mass market fintech providers typically offer lower exchange rates than banks. Pricing models are generally fixed and may be tiered, based on transaction volumes or subscription-based, depending on the provider.

- Self-serve: Fintechs often invest in tech rather than people, and “retaining a human touch” is one of the biggest challenges fintech companies face.” Consequently, many mass market fintech providers offer low-touch or no-touch support options, which may suffice for some customers. This means you can expect chatbots, self-help through FAQ articles and guides, with limited customer support. Some providers (like Revolut) promise specialised account management relationship managers, but only on their enterprise plan.

Potential Drawbacks: Limited services, support, and low reliability for SMEs

- Fewer business types supported: Mass market fintech providers may not support certain kinds of business. If your SME falls under these categories, you may experience onboarding challenges or find that their services are unavailable.

- Not a standalone banking solution: Mass market fintech providers don’t offer a full range of financial services, like those you might expect to receive from a bank. This could include loans, investments, support cheques, direct debits, or physical withdrawals.

- Pricing models are designed for individuals or small businesses: While they may seem cost-effective, the plans offered by mass market fintech providers like Wise and Revolut are usually designed with lower usage in mind. For example, Revolut lets you exchange up to £60,000 monthly at the interbank rate but only if you’re on its ‘Scale’ plan (at £90 pcm). For SMEs making regular cross-border payments for expenses like salaries or supplier payments, these low FX limits may be too restrictive and might force you into higher-cost tiers or charge additional fees.

- Unpredictable additional fees: While fintech companies tend to offer “faster, more cost-effective, and transparent alternatives tailored to SMEs”, additional fees may still apply. And, these may fluctuate depending on the provider, currency, payment timing, amount sent, or destination. For example, you may be charged extra fees for sending currency outside of an economic zone. For example, Wise charges an additional 0.48 EUR if you’re sending EUR outside of SEPA. These additional fees can make it difficult to manage cash flow if unplanned.

- Limited to no personalised support: Solutions like Wise and Revolut typically offer limited or no personalised support. If a payment gets blocked or you’re transacting with harder-to-reach jurisdictions, resolving issues can be time-consuming and frustrating without a dedicated point of contact.

- High risk of account freezes: “Customers have reported being locked out of their accounts with no warning or explanation, leading to frustration and outrage. Many were just surprised to see their accounts deactivated on login, as there was no email communication from the company about the decision.” While such actions are often tied to fraud checks or compliance reviews, and can happen regardless of who your provider is, the experiences cited above suggest this happens more frequently with these providers, and with limited support, it can take a long time to see the issue resolved, severely impacting cash flow and potentially damaging client relationships.

Who are they best for?

They are best for small SMEs with low payment volumes and standardised needs.

Mass market fintech providers are best for small SMEs and individuals with low cross-border payment volumes and standardised needs. Additionally, if you are comfortable with self-service support and standard pricing, they may be a suitable option.

Why IFX is a good fit for UK-based SMEs

IFX is an FCA (Financial Conduct Authority)- regulated payment and foreign exchange solution purpose-built for UK businesses that need to send and receive international payments.

We support businesses where complex payment flows, multi-currency needs, and regulatory challenges demand more than a standard business bank account. This could include businesses in industries such as shipping, travel, film and media, and ecommerce. Here’s what makes us a good fit for UK-based SMEs.

Access 40+ currencies, bulk payments, and up to 1,000 sub-accounts

So you can start transacting without delay, we aim to onboard clients as efficiently as possible. Complex business profiles may take longer but we’ll ensure you know what’s happening throughout. To make the process more efficient, we have account managers on hand to answer questions, help you navigate our platform and offer live demos.

You’ll receive a pricing agreement so you know what you’re paying from the start. Rather than generic volume tiers, we tailor pricing based on your business, industry, and needs. Once onboarded, your account manager will continue to support you.

You’ll also gain access to our solutions that simplify cross-border payments. This includes:

- Simplify international payments with one multi-currency account and a single IBAN: Send, receive, and hold funds in over 40 currencies, with transparent, competitive exchange rates that help you optimise your costs. A single IBAN means you can use the same information for invoicing in all currencies, saving you time, reducing admin time, and lowering the risk of errors. Reconciliation is also easier, as you don’t need to switch between different currency accounts to track your funds.

- Manage payments effectively with up to 1000 sub-accounts: To help you manage payments across different suppliers, brands, or regions separately, we let you create up to 1000 sub-accounts. Each account has its own virtual IBAN and is accessible under your main profile, simplifying how you organise and track your finances.

- Save time with mass payments: Our mass payments solution simplifies the process of paying multiple recipients in multiple regions. You can pay hundreds of payees in 70 currencies via a single CSV file upload. Our system will validate payments before processing for errors and provide confirmation of payee (CoP) for GBP payments. Currency conversions are handled automatically, further simplifying the process. Instead of taking days, you can upload payment details in minutes, saving time and freeing up your team to work on more strategic tasks.

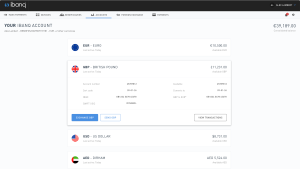

ibanq Multi-Currency Accounts page

Choose the payment network and get important payment information

To help you save and avoid unnecessary delays, we give you the flexibility to select the best payment network (SWIFT, SEPA, and Faster Payments) for each payment based on speed, fees, and the destination. Plus, every transaction for bulk payments includes an upfront quote, making it easy for you to manage pricing.

Usually, if there are any issues with payments, we’ll attempt to get in touch. You’ll always have someone to speak to if you need support or if you run into issues like failed or delayed payments.

Get fast support and tailored client service for smoother payments

Cross-border payments can be complex. If you’re stuck with poor customer support, delays, and errors, it can hurt your operations and client relationships.

That’s why we take a service-led approach, helping you manage cross-border payments more efficiently and cost-effectively. From your very first day as our client, we assign you a dedicated account manager. That way, you get direct access to someone who knows your name, understands your business, and can step in quickly when needed.

Whether it’s a missing payment, a delay, or another issue, you can call or email without having to explain everything from scratch. Unlike banks and other providers, we don’t wait for you to tell us there’s a problem. We proactively get in touch to discuss issues on our end and help you resolve them before they escalate.

And because our teams have deep knowledge of cross-border payments for businesses, you can have peace of mind that you’re receiving tailored client support that addresses your specific challenges.

How a machinery exporting company expanded to new markets and improved FX cost efficiency with IFX

A UK-based machinery exporting company with clients in Europe, America, and Asia, wanted to be able to receive funds and issue invoices several times a day. However, the company’s cross-border payments were spread across multiple providers, making the process fragmented, slow, and inefficient.

Our dedicated teams worked closely with the company to understand key details, including its:

- Payment flows

- Business goals

- Budget

- Product costs

- How FX fit into their cost of goods sold

Once partnered with us, the company migrated all its international payments to our single multi-currency account, making IFX its sole cross-border payments solution. We helped the company manage its FX costs more effectively, aiding its expansion into other markets.

We also provided tailored, ongoing client support, ensuring its payments ran smoothly. As a result, the company saved time, simplified its operations, and gained control over its cross-border payments.

Choose an international business account designed to scale with you

To scale confidently, you need features purpose-built to support SMEs and a provider that understands the complexities of cross-border payments. Look for a solution that offers:

- Multi-currency capabilities and currency exchange, allowing you to do business globally without limitations.

- Faster, more transparent payments for better visibility and control.

- Tailored pricing designed to meet your needs and goals.

- Reliable account access and streamlined user experience.

- Personalised support and account management to resolve issues quickly and keep payments running smoothly.

Ultimately, the right solution combines reliable infrastructure and dedicated service so you can focus on growth, not international payment hurdles.

The contents of this article do not constitute financial advice and are provided for general information purposes only. Links to third-party websites are included for convenience only, and IFX Payments holds no responsibility for the content, services, products, or materials on those sites.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary, and customers agree to proceed at their own risk.